Paid Time Off options available during COVID-19 pandemic

Effective April 1, 2020, the Federal Emergency Paid Sick Leave (EPSLA), COVID-19 PTO Supplemental and Expanded Family Medical Leave Act (EFLMA) have been added as paid time off options for faculty and staff. Specific criteria apply to each offering, so please make sure to review each program carefully. A chart with more information by scenario is available here.

A detailed explanation of the usage case and time coding for each of the time off banks is available in the April 2 Timekeeper Update. You can also find the information on the Michigan Medicine Human Resources COVID-19 Time Reporting page.

Heavy call volumes

We are experiencing a high volume of calls and emails during this time, so we appreciate your patience as we work through this rapidly changing environment to provide you with the most up-to-date information. If you have questions, we first encourage you to view the timekeeper FAQs and/or the HR FAQs. If you still have questions, please call the Michigan Medicine payroll line 734-615-8722 and leave a voice message. Our staff is checking voice messages frequently and we are responding as quickly as we can.

If you prefer not to leave a voice message you may email the team at HR-Payroll@med.umich.edu. The Payroll team is here to answer all of your timekeeping questions.

Employee time reporting questions

Employees with time reporting questions/issues, including incorrect reporting, should work with their department timekeepers or direct supervisor. Departments must communicate the time reporting process to staff and who within the department they can contact for help with timesheet or paycheck questions/issues. Our Office would not be able to authorize adjustments to hours worked, PTO usage and other employee-related concerns. All adjustments to pay or leave time must be authorized by the department.

Timekeeper Tip

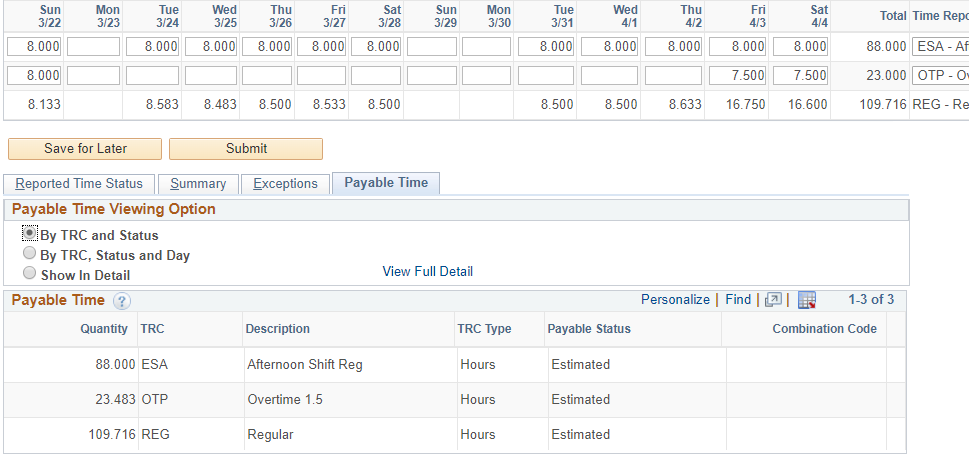

When viewing the timesheet page in M-Pathways there is an option to view “Payable Time” (once time admin has run) at the bottom of the page. Click the third tab to see “Payable Time”. You will initially see detail by date under report. Select “By TRC and Status” top radio button to view the Payable Time summarized by Time Reporting Code (TRC). This is helpful when comparing what is summarized on the timesheet (Reported Time) to Payable Time.

Below is an example of how the overtime rule created some additional overtime pay (OTP) for this employee. This would prompt the person reviewing time to correct the time reported in the timesheet to correct the error. The over rules should not be relied upon but act as a safety net to ensure accurate pay for overtime.