Important Reminder for Payroll Cut-off Mornings

Please be available to respond quickly to questions prior to the 10 a.m. payroll cut-off. If you will not be available, identify a backup that your pay analyst can contact on cut-off mornings and make sure it’s added to an automatic reply on your email.

Additionally, please wait until after 12noon to send any inquiries NOT related to the cut-off as the team is focused on cut-off audits and trying to meet deadlines to get everything reviewed and corrected.

Thank you for your attention to this important request!

How to Determine a Correct Termination Date

The termination date is:

- the day after the last day worked (includes retirements)

- the day after the last day paid if on a paid leave (i.e. no return from Extended Sick leave)

- or, the day after employee was to return to work from an unpaid leave (in this case the employee is returned from leave and terminated on the same day

SPG Termination policy (201.40): https://spg.umich.edu/policy/201.40

Understanding Exempt (Salaried) Monthly Pay

Exempt employees are paid a salary each month that is equal to their annual salary divided by 12 (months). This results in a consistent paid salary each month even though the number of work days in each month varies. An exempt employee's monthly pay amount is NOT calculated based on hours worked or an hourly rate. This is a follow up to last week's article Defining Monthly Salaried Pay

Reporting OTR vs the correct FTE for a month results in different pay

Exempt monthly paid employees generally do not get paid extra for working additional hours. There are some special cases where departments have HR approved incentive agreements in place due to severe staffing shortages.

All incentive agreements MUST be approved by your HR Compensation Analysts prior to paying for additional hours worked for exempt staff to ensure compliance.

If you know in advance a monthly paid exempt employee will be working additional hours for an extended period of time (3-6 months) and the hours will be consistent, the FTE should be updated for those months before the employee works. Please avoid retroactive changes when possible.

- If the additional hours will be random, short term, and inconsistent or only for a couple months then using OTR is acceptable.

When OTR is reported for an exempt monthly paid employee the system will apply an annualized hourly rate to those hours. The annualized hourly rate is their annual salary multiplied by 2080 for a full time appointment. The actual hourly rate for any given month is going to be different from the annualized hourly rate. This is due to there being a different number of workdays in each month.

Example1: OTR vs correct FTE in August 2021

- Full Time Base Salary = $3,000 * .8 FTE = $2400 Monthly Base Pay

- Employee works full time in the month (40/week)

- If the FTE was 1.0 the salary will be:

- Total $3,000

- If you report OTR (32 hours); there are four Friday’s in August

- $2,400 + 32*$17.3077 (annualized hourly rate) = $553.85

- Total $2,953.85

Example2: OTR vs correct FTE in December 2021

- Full Time Base Salary = $3000*.8FTE = $2400 Monthly Base Pay

- Employee works full time in the month (40/week)

- If the FTE was 1.0 the salary will be:

- Total $3000

- If you report OTR (40 hours); there are five Friday’s in December

- $2,400 + 40*$17.3077 (annualized hourly rate) = $692.31

- Total $3,092.31

*Using OTR will sometimes result in less pay and sometimes more depending on the month.

PTO accrual: Additionally, if reporting OTR consistently for one quarter the department will need to manually add the appropriate PTO accrual to the employee’s bank by using the Incremental PTO process and reporting OAP on the timesheet to add the hours. Having the correct FTE doesn’t require the manual PTO accrual adjustment process.

New Queries

Find these two new M-Pathway queries to support your work:

MTL_EMPLOYEES_BY_DEPT_TLGRP: Formerly known as MTL_EMPLOYEES_BY_DEPT.Lists all current static and dynamic groups (Time & Labor groups) for all employees in a deptID. Use this to ensure all employees are in the correct dynamic and/or static groups.

- MTL_ACTIVE_EMPLOYEES_BY_DEPT New query which lists everyone in a deptID with the following information:

- EMPLID

- Rec#

- Job Code

- Job Description

- Workgroup

- Paygroup

This query can be used to see all active staff in a deptID, check the employee type (workgroup) of staff in a deptID; and verify the time entry method of all employees in a deptID.

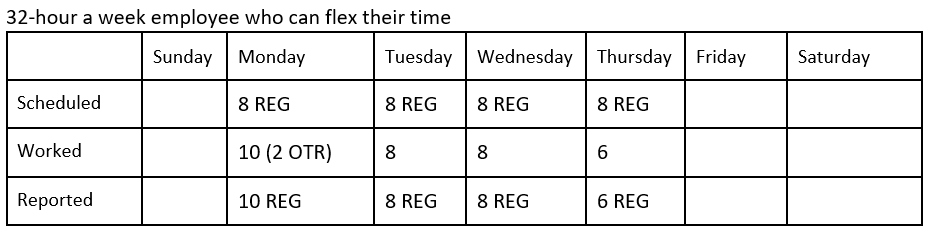

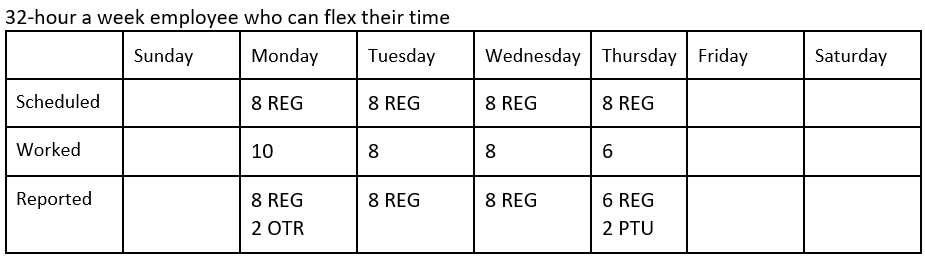

Reporting Time When Employees Work Over Then Arrive Late on Another Day in the Same Week

When non-exempt biweekly paid employees work over their appointment but haven’t yet worked 40 hours in the week, OTR (over appointment regular) is reported so they are paid the additional hours. If there is a later arrival later in the week (after working an over-appointment shift) please do NOT report a No pay code if there is OTR reported in the same week. Just reduce the OTR hours or report the time missed as PTO.

Example: A part-time employee works over their appointment then arrives 2 hours late later in the week. They are allowed to flex their schedule. The OTR hours should be changed to REG as shown below.

If flexing is not allowed, report PTO for the late arrival (if available) and the OTR remains. If the employee does not have PTO available then report the time as shown in the example above.

**Please do not report OTR and No pay in the same week. Instead, flex their time or report PTO if they have it in accordance with the UMHS PTO Policy.

To find previous editions of Timekeeper Updates, or to request to be added or removed from the Timekeepers Network email group, visit the Timekeeping & Pay on the MMHR website.

If you have further questions, please reach out to your pay analyst directly. If you do not know who your pay analyst is, please check here. We are experiencing a high volume of calls and emails during this time, so we appreciate your patience as we work through this rapidly changing environment to provide you with the most up to date information.