COVID-19 PTO Banks Ending

Effective May 14, with the start of a new biweekly pay period, access to the university’s emergency COVID-19 paid time off (PTO) program will end. The last date for employees to utilize their COVID-19 PTO is May 13. Michigan Medicine’s 120-hour special-use PTO bank will also be discontinued as of May 14.

COVID PTO time was reported using a combination of the RPN and PAN timekeeping codes. As of May 14, employees should no longer report RPN/PAN time, and time approvers should no longer approve this combination of time reporting codes.

Absences for COVID should be reported using existing time reporting codes for short term sick, extended sick (COVID absences of 10 or more business days), PTO or vacation, as appropriate.

Questions can be directed to COVID-19HR@umich.edu

May 2023 Sell Back Reminders

Eligible employees selling back PTO are to be paid in the last paycheck in May (2023) for hours they are eligible to sell.

Review full details and requirements of Sell Back Programs by Employee Type:

PTO Sell Back Request form submission dates (allows time to report hours):

- Biweekly employees: May 1 - 15, 2023

- Monthly employees: May 1 - 24, 2023

Verify employees did not already sell back PTO this year by:

- Reviewing Gross Pay Registers for December-April, including off-cycle payrolls.

- M-Pathways query

- MTL_GROSS_PAY_BY_GROUP

- Reviewing Payable Time for December-April

- M-Pathways queries

- MTL_TRC_BY_DEPT

- MTL_TRC_BY_GROUP

Report eligible PTO sell back hours in these pay periods using the PTB code no later than May 15 at 7pm :

- Biweekly: 4/30 - 5/13

- Monthly: 5/1 - 5/31

**Please note, departments that interface may want to report PTB as a prior period adjustment to avoid having the hours overridden by the file or wait until the file is loaded before reporting the hours.

If Sell Back hours are not reported before the cut-off for the last check in May, report the hours as a prior period adjustment in the pay period noted above to pay out on the following check.

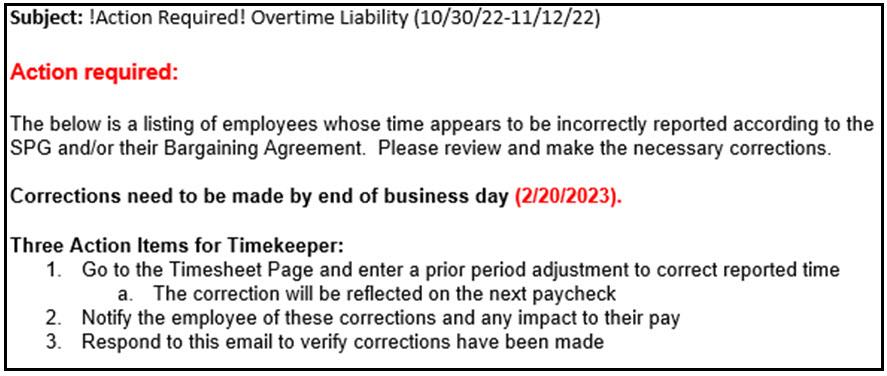

Overtime Liability Audit

It is a requirement to pay non-exempt employees overtime at 1.5 times their hourly rate for all hours worked over 40 in a week based on the Fair Labor Standards Act and as described in Michigan Medicine policies and collective bargaining agreements.

After each biweekly payroll, the U-M Health Payroll Office runs an overtime audit. The audit checks for missing Overtime and for Overtime that should not have been paid. The team reviews each employee on the report to verify needed corrections. Notifications are sent to timekeepers asking them to make corrections on the timesheet then respond to the email letting us know corrections were made. Once a response is received the payroll team must review and verify the changes were done correctly.

Sample Notification:

We ask timekeepers to complete all three action items within 24-48 hours of receiving the notification.

The payroll team strives to send out notifications timely. We aren’t always able to due to the volume of errors. We ask departments to thoroughly review and audit for inaccurate overtime reporting and correct all errors prior to each payroll running. Be sure to include hours worked on all timesheets when employees are working multiple non-exempt jobs.

Our hard-working healthcare workers and support staff deserve to be paid accurately and on time and it is our responsibility to educate ourselves and take the necessary steps to ensure this happens each and every paycheck.

Overtime Pay Resources:

- Overtime Chart

- Overtime Standard Practice Guide 201.38

- Union Contracts

- Department of Labor Overtime Pay Guidance

- Overtime Video from the Payroll Information for Managers Series

Also: