FLSA Rate Adjustments on Overtime – Backlog

MM HR-Payroll runs a report after every biweekly payroll to identify needed adjustments to overtime pay in situations where the FLSA rate is calculated incorrectly due to Overtime and No pay that is reported in the same week.

When Overtime (1.5 pay) is reported in the same week as No pay (ETW, UET, PSW, PUW) the system does not calculate the correct FLSA rate that is used on the .5-time portion of the 1.5 rate overtime pay.

What is this FLSA rate?

It is a requirement of the Fair Labor Standard Act that non-exempt employees are paid a standard rate on the half time portion (.5) of the time and a half (1.5) overtime pay that is based on base pay earnings plus any additional non-discretionary pay such as shift premium, on-call or certain lump sum payments. The requirement includes adding all the pay together and then dividing by the number of hours worked in each week which provides a slightly higher hourly rate which is then applied to only the half time (.5) portion of the time and a half (1.5) overtime rate. The 1.0 portion of the overtime pay is paid using their base hourly rate.

Example: Employee makes $20/hour and works 40 hours a week on the afternoon shift, picks up 2 additional hours that is paid as overtime in the same week

Calculation:

Add base earnings + shift premium + OTP at straight time rate.

$800 (40 REG)

+ $40 (40 ESA)

+$40 (2 OTP -just the straight time portion of the OT is added)

= $880 total

Divide by number of hours worked that week (42)

= $20.95 (the FLSA rate)

Apply the FLSA rate to the .5 portion of the 2 OTP hours.

2 * .5 * $20.95 = $20.95

Add to $880 total above = $900.95 paid for the week

To learn more about FLSA rate and how it is calculated visit the UM Payroll - Finops Website which provides more detail.

Why are we telling you this?

The team recently completed a backlog of these adjustment reports and uploaded the pay adjustments into additional pay using the Earnings code “OTL”. The adjustments will pay on the next biweekly paycheck 12/5/2023. You may get questions from staff wondering what the payments are for. Most that get these adjustments receive them repeatedly because they consistently report Overtime (OTP, OTM) and No pay in the same week.

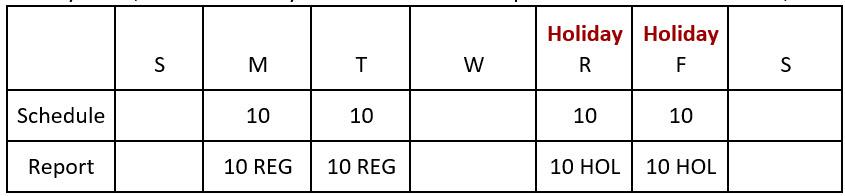

Holiday Time Reporting – Non-bargained For Employees

When the holiday falls on a normally scheduled workday and will be included in their standard hours for the week, Holiday pay (HOL) is reported based on prorated hours (standard hours /5) or regularly scheduled hours, whichever of the two is greater.

When the holiday falls on a day normally scheduled off and is not being reported as part of their standard hours for the week, Holiday on an Off Day (HOM/HOP) is reported based on prorated hours (standard hours /5).

Example 1: 40 standard hours/1.0 FTE employee normally works four 10-hour shifts Mon, Tues, Thurs, and Fri. During the Thanksgiving holiday week, the two holidays will be scheduled as part of their standard hours, working 10 hours Mon & Tues.

Example 2: 40 standard hours/1.0 FTE employee normally works four 10-hour shifts, Mon-Wed & Sat, not normally scheduled to work on Thursday or Friday.

Example 3: 30 standard hours/.75 FTE employee normally works three 10-hour shifts, not normally scheduled to work on Thursday or Friday.

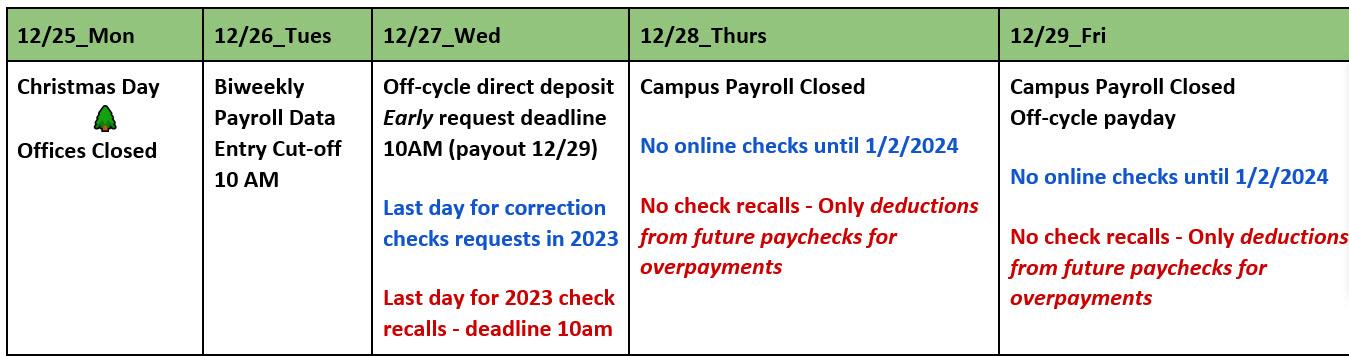

Payroll Schedule & Deadlines – Christmas Week 2023

Please see schedule below and plan your work accordingly. The MM HR-Payroll Team will be here all week with the exception of Monday.

*If you will be off this week please include who we can contact in your absence, in your Out of Office message. Thank you!

2024 Leave Accrual Schedule

The 2024 Leave Accrual Schedule is now available on the U-M Payroll website. This resource shows when Paid Time Off (PTO) and Vacation accruals are available in employee leave balances.