Punch & WebClock Timesheets – Reporting and Paying Overtime

To all department timekeepers and approvers who handle employees who punch:

- Timekeeping for employees punching Kaba Clocks that interface time into M-Pathways.

- Timekeeping for employees using the M-Pathways WebClock functionality.

It is vitally important that additional auditing of these timesheets be done within each department or unit to ensure the accurate reporting and payment of Overtime by someone familiar with all of the overtime pay rules.

Validating overtime is paid accurately and in accordance with the FLSA (Fair Labor Standards Act) and with U-M Health policies, UM Standard Practice Guides (SPG’s), and contracts is a requirement of each individual department.

Holiday weeks can be especially challenging when reporting and paying Overtime correctly with all the added rules and variables in employees' work schedules.

The U-M Health Payroll Team does some auditing of overtime centrally to support accurate paychecks. However, we are greatly limited in our ability to audit punch timesheets due to the nature of how time is collected and reported, in addition to not knowing the employees original schedule and what changes came later to their actual work schedule.

Other constraints:

- Incremental minutes punched.

- Duplicate coding on the timesheets for exception time such as, hours worked on a holiday (non-Christmas HWT), over-appointment hours worked (OTR), Overtime (OTP), and sometimes Hospital business (HPB) or Union Business (USB), for example.

Due to reasons listed above and others, the organization relies 100% on each unit to report and pay overtime correctly, and to audit and correct any errors. In addition, the responsibility to produce adequate records during an audit of overtime pay from any internal or external department or agency lies within each reporting department.

If any support is needed in this area please do not hesitate to reach out to us for guidance or assistance with questions.

The FLSA requires all non-exempt employees are paid Overtime time and a half (OTP) whenever working over 40 hours in a work week (Sun-Sat). There are additional requirements for overtime and other similar types of pay in the various bargaining agreements, and U-M Health policies, and UM Standard Practice Guides (SPG’s) that dictate how non-bargained for employees are paid.

Overtime Pay Resources:

- Overtime Chart

- Overtime Standard Practice Guide

- Union Contracts

- Department of Labor Overtime Pay Guidance

- Overtime Video from the Payroll Information for Managers Series

Also:

PTO Sell Back 2024

PTO sell back forms for eligible employees (non-bargained for employees, and AFSCME, MNA/UMPNC & UPAMM bargained for employees) should not be submitted to department timekeepers or supervisors earlier than January 1st, 2024.

All requests should be submitted no later than January 16th, 2024. This is to allow time for data entry before the payroll cut-offs on Jan. 23, 2024 (Biweekly), and Jan. 25, 2024 (Monthly).

Be sure to review the links below for program details including other sell back programs (i.e., Sick Sell Back for Trades Bargained for employees) and eligibility based on employee type.

Note: In accordance with the U-M Health & Shared Service Non-Bargained for Staff PTO Guidelines, 04-06-010, to remain eligible for the PTO Sell Back payout employees must remain on an eligible PTO plan for the entire pay period in which the PTO hours are paid out. (see below) This means if an employee transfers to a new position that does not have the PTO plan (e.g., UM Campus Vacation & Sick plan) at any point during that period, they are no longer eligible to sell back any PTO hours.

- Biweekly pay period: 1/7/2024 - 1/20/2024

- Monthly pay period: 1/1/2024 – 1/31/2024

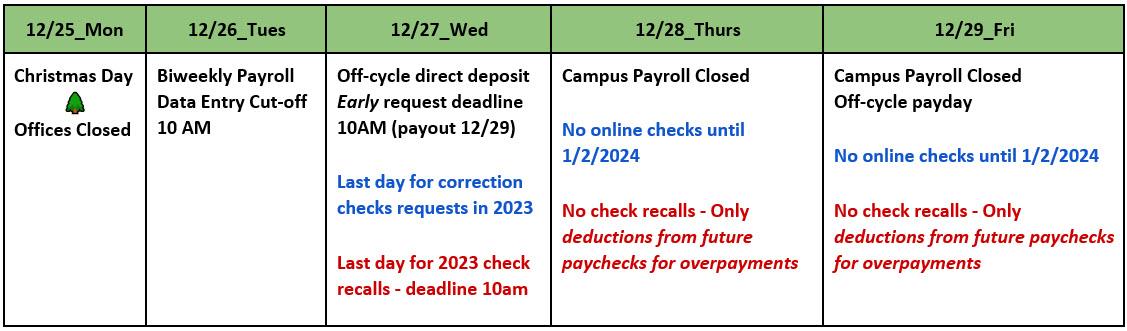

Payroll Schedule & Deadlines – Christmas Week 2023